The current state of play in the drybulk market where there is a sense of anticipation amongst buyers for opportunities over the coming weeks.

Three Capesize bulkers are reported sold.

Cape Friendship (185,879-dwt, 2005 Kawasaki) is understood to been have picked up by a Chinese buyer for $16.1m with DD due in June this year.

London based Zodiac are said to have sold two of their vintage Capes to as yet undisclosed buyers in an en-bloc deal worth $30m – Cape Heron (177,656-dwt, 2005 Mitsui SS/DD 02/25) and Cape Hawk (176,996-dwt, 2006 Namura SS 10/26 DD 03/25) both with DD due imminently (this month and March respectively).

By way of comparison, the 2005-built Salt Lake City (171,810-dwt, 2005 Daewoo) was sold three weeks ago for $16.2m, also to Chinese buyers.

The non-eco Kamsarmax from the Chronos fleet, Patra (80,596-dwt, 2012 Universal) has found a buyer in Brave Maritime. The Greek Owner is understood to have paid $15.75m for her with a time-charter attached at 95% of the BPI until August/November 2025. She has surveys due in October this year.

Unconfirmed reports the vintage Panamax Rose (76,619-dwt, 2008 Shin Kasado) has been sold to Chinese buyers for $10.8m – quite a firm price considering she has drydocking due in 2 months.

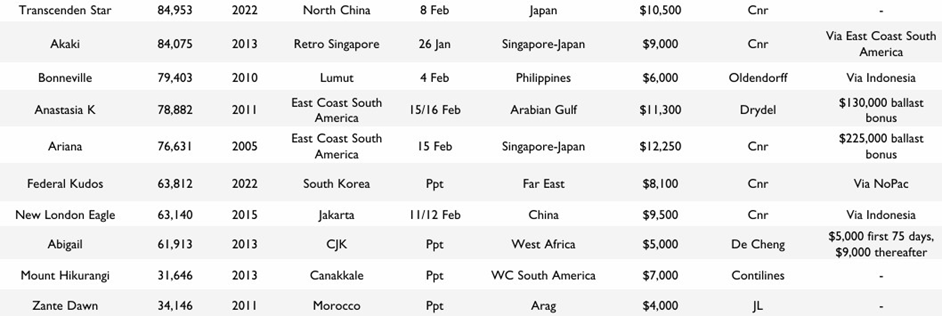

Dry Cargo Market Fixtures :

After several years of booming orders across ship types, cross sector newbuild prices (CNPI index)

currently stand 40% higher Chinese $10.8m Unconfirmed / DD due very marginally, down 1% since September. On the one hand there is a plausible case that this recent small tick downwards could than they did 5 years ago at the start of 2020. After bottoming out during late 2020 in the depths of the Covid-19 pandemic, the rise in prices has been fairly continuous except for a brief downturn in the second half of 2022. In tangible terms, a newbuild Ultramax price bottomed out in Q4-20 at $24m, today it stands at a tick below $35m: a 46% rise.

Larger vessels rose even further.

Cape-size by 53% over the equivalent period. Similar rises have been seen across other sectors, MR2s rising from trough to peak by 38%, 2,700- TEU containers by 36%.

In recent months however, there have been signs that prices have started to plateau, and the drybulk- specific index has even softened and accelerate into a tangible fall in prices over the next few months.

New Building Ordering interest does seem to have stalled of late across sectors, and shipyards have ramped up capacity: both from a facilities and productivity perspective. On the other hand, with most leading yards sat on at least three years of orders, there will be little near term need or incentive to cut prices dramatically.

As we have seen of late in the S&P market, there is so much cash looking for a good deal in every sector, that any modest cut in prices could lead to a stampede back to the yards.

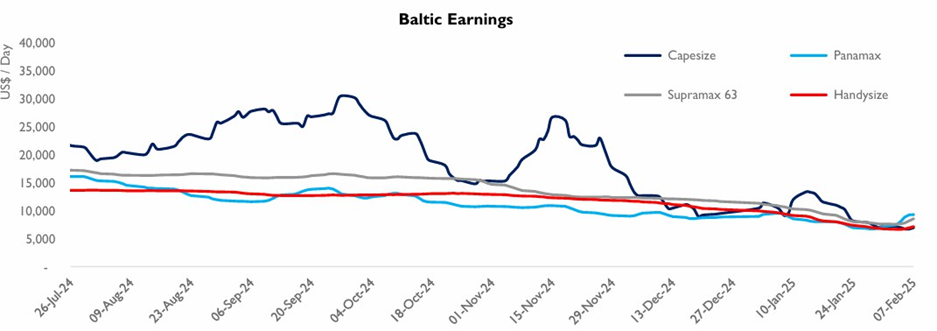

Baltic Exchange Index 12.2.2025 Capesize 182

C5TC 182 Weighted TC Average $10,337 Minus 732

Capesize Index

5TC Weighted TC Average $5,899 Minus 559 Panamax 82 Asia Index

P5_82 S.China Indo Round $6,436 Plus 317 Supramax Asia Index

S3TC Weighted TC Average $7,821 Plus 185 Handysize Index

7TC Weighted TC Average $7,534 Plus 191

Fixtures:

NYK TBN 75,000/10 Richards Bay / Visakhapatnam 18/24 Feb $11.25 fio 12,000/15,000 shinc both ends.

Frosso K 2010 57,047tdw dely Fujairah prompt redelivery Bangladesh intention Limestone $6,500.

RB Jordana 2016 81,301tdw dely aps US.EC. 24 Feb trip redel India $14,250 + $425,000 BB

Marex Media