Dry Markets –

Typically, late July’s dry bulk shipping reports are vibrant, filled with speculations on the Baltic indices’ peaks. However, this year has been an anomaly, with such discussions vanishing into obscurity. On Thursday, the Baltic Dry Index (BDI), a key activity indicator in the dry bulk sector, plunged back into the three-digit range, ending the twenty-ninth week at 950 points. The volatile Capesizes succumbed to recent downward pressures, stabilizing at $11,958 daily.

Similarly, the grain-trading workhorses recorded losses, with BPI82 TC levels closing at $8,320 daily. Supramaxes stood out positively, being the only segment in the green at $8,333 daily. Conversely, Handies dropped another $167, closing at $7,202 daily on Friday. This summary encapsulated Doric’s Weekly Insight twelve months ago.

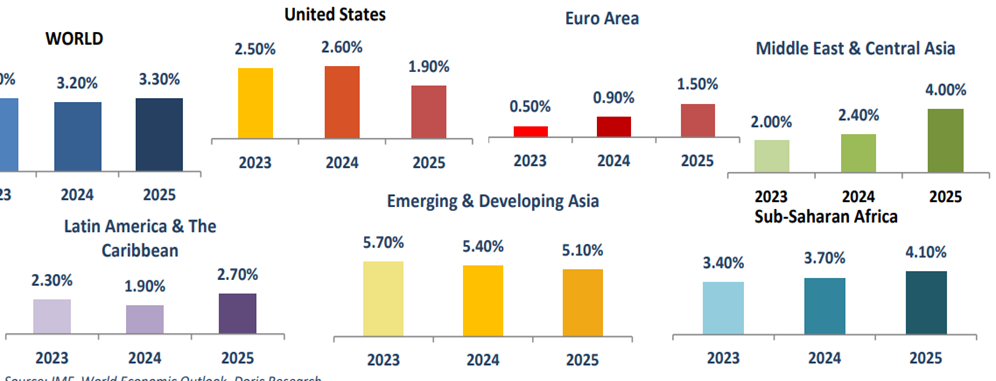

A year later, market has shifted significantly. The Baltic indices showed relative stability during the twenty-ninth trading week, with the exception of Capesizes. The Capesize index notably reported a 9.8 percent weekly loss, closing this Friday at $24,652 daily. Panamax and Supramax indices hovered close to each other, finishing at $15,427 and $15,117 daily, respectively. Handies saw a 1.5% weekon-week increase, concluding at $13,543 daily. On the macroeconomic front, the International Monetary Fund (IMF) updated its economic outlook on Tuesday.

It raised growth projections for China, India, and Europe, while slightly lowering them for the United States and Japan. The IMF emphasized that global progress against rising prices has been hindered by stubbornly high inflation in the services sector, affecting everything from airline travel to dining out. Global growth is forecasted to align with the April 2024 World Economic Outlook (WEO), at 3.2 percent in 2024 and 3.3 percent in 2025. Global economic activity and world trade strengthened at the year’s turn, driven by robust exports from Asia.

First-quarter growth exceeded expectations in many countries, despite notable downturns in Japan and the United States. In the US, growth projections were revised down to 2.6 percent for 2024 (0.1 percentage point lower than April projections), reflecting a slowerthan-anticipated start to the year. Japan’s negative growth surprise resulted from temporary supply disruptions, including the shutdown of a major automobile plant in the first quarter. Conversely, the euro area appears to have stabilized, with a modest 0.9 percent growth expected for 2024, revised up by 0.1 percentage point.

Growth forecasts for emerging markets and developing economies were revised upward, driven by stronger activity in Asia, especially China and India. China’s growth is projected to rise to 5 percent in 2024 due to a rebound in private consumption and strong firstquarter exports. However, GDP growth is expected to notably slow to 4.5 percent in 2025.

India’s growth forecast was revised up to 7.0 percent for this year, reflecting improved prospects for private consumption, particularly in rural areas. Global trade is set to recover, with world trade growth expected to rebound to about 3.25 percent annually in 2024-25, aligning with global GDP growth. Although cross-border trade restrictions have increased, impacting trade between geopolitically distant blocs, the global trade-to-GDP ratio is expected to remain stable in the projection.

As we progress through late July, the dry bulk shipping market exhibits a relatively calm state. The market has integrated much of the IMF’s upward revision in projections and increased trading activity from China, significantly boosting this year’s Baltic index averages. Despite the current stability, there might be notable uncertainties on the horizon.

Analysts suggest that the primary driver of China’s commodity imports is price, with economic conditions playing only a secondary role. The emphasis on price as the main driver of China’s commodity imports indicates a potential for fluctuating demand, which could impact shipping rates and market stability. Additionally, the potential for renewed geopolitical tensions, particularly in light of the upcoming US presidential election, introduces a significant element of risk.

The accumulation of commodity stockpiles, including soybeans, iron ore, and coal, further complicates the market outlook. While they are set against the backdrop of a typically strong second half of the trading year, these factors contribute to a cautiously optimistic view.

GROWTH PROJECTIONS JULY 2024

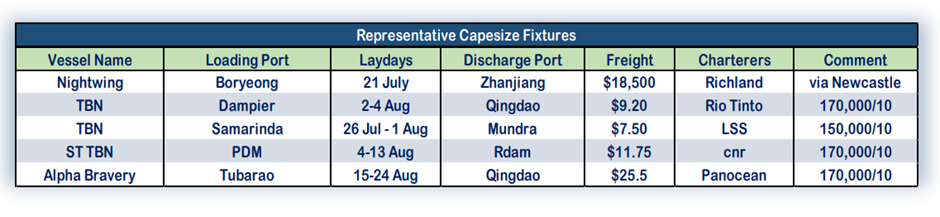

Capesize

Alongside the decline in iron ore futures prices, which fell to a nearly three-week low on Wednesday due to weak seasonal demand from China and rising global supply, the Baltic Capesize Index Time Charter Average concluded the week at $24,652. This represents a 9.8% decrease week-on-week.

Pacific

In the Pacific, according to latest survey, total inventories of imported iron ore at the 45 major Chinese ports have reached a new peak since mid-April 2022. As of July 18, the inventory volume climbed by an additional 1.4 million tonnes, or 0.9% from the previous week, totalling 151.3 million tonnes. Additionally, during the first half of the year, China produced 554.4 million tonnes of run-ofmine (ROM) iron ore, marking a substantial 13.2% increase compared to the same period last year, according to the National Bureau of Statistics (NBS). June’s output alone reached 96.6 million tonnes, reflecting a 9.2% month-on-month rise and a 13.5% increase year-onyear.

From Australia, BHP Group reported record annual iron ore production for the second consecutive year. This achievement was fuelled by favourable weather conditions and heightened output from its South Flank operations in Western Australia. The world’s largest listed miner also exceeded analyst expectations for both quarterly iron ore and copper production, as detailed in its production report. In the spot market, the C5 route experienced a retreat of approximately 3%, settling at $9.725 per metric tonne. On the time charter front, the C10_14 (Pacific round voyage) route concluded at $21,095 daily, representing a 6% decline compared to the previous week. For this route, Richland secured the ‘Nightwing’ (170k/2006) for delivery in Boryeong on July 21, for a voyage via Newcastle to Zhanjiang at $18,500 daily.

Additionally, Rio Tinto booked a ‘TBN’ for a 170,000/10 cargo from Dampier, loading between August 2-4, to Qingdao at $9.20 per metric ton. In the southern region, LSS chartered a ‘TBN’ for a 150,000/10 coal shipment from Samarinda, loading between July 26 and August 1, destined for Mundra at $7.50 per metric tonne. Atlantic In recent developments within the Atlantic commodity sector, Rio Tinto has given the green light to the Simandou high-grade iron ore deposit project in Guinea, West Africa.

This project, set to be the largest new mine development globally, will involve constructing over 600 km of multi-use trans-Guinean railway and port facilities, designed to facilitate the export of up to 120 million tonnes of iron ore annually. Initial production from the Simfer mine is anticipated in 2025, with a full ramp-up to an annual capacity of 60 million tonnes over 30 months, of which Rio Tinto’s share will be 27.5 million tonnes. In Brazil, mining giant Vale is optimistic about reaching the upper end of its 2024 iron ore production guidance following a notable increase in output during Q2. Vale reported a 2.4% year-onyear rise in production, totalling 80.6 million metric tons by the end of June.

Meanwhile, data from latest survey highlights a 2% decrease in the total volume of iron ore shipments from 19 ports and 16 mining companies in Australia and Brazil from July 8-14. The volume dropped by 493,000 tonnes to 24.7 million tonnes, primarily due to reduced shipments from Australia. In the spot market, the C8_14 (T/A rv) route saw a 10.3% week-on-week drop, settling at $25,750 daily, while fronthaul runs on the C9_14 route fell by approximately $8,000 daily, concluding at $55,188 daily. Vale was reported to have booked a ‘ST TBN’ voyage for 170,000/10 from PDM 4-13 August to Rotterdam at $11.75 per metric ton.

Additionally, the C3 route from Brazil traded at $26.050 per metric tonne, roughly 4% lower week-on-week. The ‘Alpha Bravery’ was fixed for 170,000/10 from Tubarao 15-24 August to Qingdao at $25.5 per metric tonne with Panocean. On the period front, not much has been reported this week.

Total inventories of imported iron ore at the 45 major Chinese ports have reached a new peak since mid-April 2022. As of July 18, the inventory volume climbed by an additional 1.4 million tonnes, or 0.9% from the previous week, totalling 151.3 million tonnes, according to latest survey.

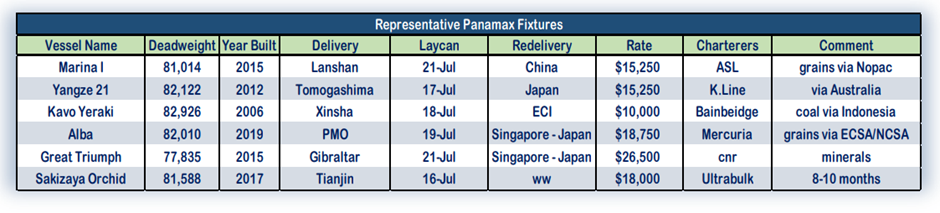

Panamax A lukewarm week for the Panamax market, with The P82 average index gaining circa 2.1% W-o-W, eventually settling at $15,427 daily.

Pacific

In the Pacific commodity news, during June, China’s total coal imports reached 44.6 million tonnes (MMT), marking a 5% increase month-on-month (m-o-m) and a 12% rise year-on-year (y-o-y), according to customs data released last Friday. This surge was driven by seasonally higher power demand and favourable coal import conditions amid reduced domestic coal output compared to last year’s peaks. Although the initial data does not distinguish between thermal and metallurgical coal, the rise in imports is likely attributed to an increase in thermal coal volumes, which made up 75% of total coal imports over the past year. Conversely, South Korea’s total coal shipments in June fell by 5.2% m-o-m to 8.46MMT, a 10.2% decrease y-o-y, primarily due to low thermal coal imports.

Thermal coal shipments dropped by 13.2% m-o-m to 5.86MMT and were down 14.8% y-o-y. Notably, thermal coal imports from Indonesia, South Korea’s largest supplier, rose by 3.7% m-o-m to 1.81MMT and by 8.1% y-o-y, capturing 31% of the market share. Shipments from Australia, the second largest supplier, fell by 20% m-o-m to 1.08Mt but increased by 24.7% y-o-y, holding an 18% market share. Additionally, thermal coal imports from Russia surged by 86.2% m-om to 1.29Mt, despite efforts to curb Russian imports. Coking coal imports to South Korea rose by 19.7% m-o-m to 2.60Mt, up 1.9% y-oy, with Australia remaining the top supplier, holding a 64% market share.

On the fixtures front, respective Far East routes moved on opposite directions compared to last Friday. The P3A_82 HK-SKorea Pacific/RV recorded a marginal increase of 0.7% while the P5_82 S. China Indo RV recorded a drop of 2.4%. From NoPac ‘Marina I’ (81,014 dwt, 2015) was fixed from Lanshan for a staple grains run back to China with Messrs ASL at $15,250 pd. On Australian runs ‘Yangze 21’ (82,122 dwt, 2012) was was reportedly agreed at $15,250 with delivery Tomogashima, via Australia back to Japan with Messrs K.Line. From Indonesia ‘Kavo Yeraki’ (82,926 dwt, 2006) opted for a coal run to East Coast India at $10,000 dop Xinsha with Messrs Bainbridge.

Atlantic

In the Atlantic commodity news, over the month of July, Brazil’s soybean exports continued at a robust pace, surpassing last year’s figures, while corn shipments faced challenges. According to customs data from July 15, soybean exports reached 5.2 MMT in the first two weeks of the month, compared to 9.6 MMT for the entirety of July 2023. The average daily shipment volume for soybeans was 0.53 MMT, an increase of 13.9% from the previous year’s daily average of 0.46 MMT.

The Brazilian grain exporters association, Anec, projected July’s soybean shipments to total 10.3 MMT. In contrast, Brazilian corn shipments were slow, totalling 0.85 MMT in the first half of July. This is a significant decrease from the 4.2 million tonnes exported in July 2023. The daily average volume shipped was 0.085 MMT, down by 56% from last July’s daily average of 0.2 MMT. Anec forecasts corn shipments for July at 4 MMT. Soybean meal exports amounted to 0.85 MMT in the first two weeks of July, compared to 2.2 MMT for the entire month of July 2023. The average daily export rate for soybean meal was 0.085 MMT, a 19.8% decrease from last year’s daily average of 0.1 MMT. Anec projected July’s soybean meal shipments at 1.89 MMT.

Additionally, Brazilian exports of vegetable oils and fats, primarily soybean oil, reached 0.1 MMT in the first half of July, compared to 0.23 MMMT in July 2023. The average daily shipment volume was 10,326 tonnes, down by 4.8% from last year’s daily average of 10,849 tonnes. In the spot arena despite aspirations for improved fixture levels the P6 route eroded by about 3.3% W-oW concluding at $16,775 pd. The well described ‘Alba’ (82010 dwt, 2019) obtained $18,750 from Mercuria for a grains haul via ECSA to Far East with PMO delivery. In north Atlantic the sentiment was more upbeat with the transatlantic round voyage as measured by P1 route increasing by 10% weekly and settling at $14,250. The tonnage scarcity in the area is evident which hopefully with a bit more cargo inquiry next week shall keep the pace up. The fronthaul route P2 only increased by 4% w-o-w concluding at $27,168. The ‘Great Triumph‘ (77,835 dwt, 2015) from Gibraltar was rumoured at $26,500 daily for a minerals trip to Far East.

The Med-Black Sea region continues to be the most uninspiring area with very little activity observed. With the forward freight market lacking momentum and the spot market in similar vein, period activity was far from vibrant. Nevertheless some fixtures were concluded such as the ‘Sakizaya Orchid’ (81,588 dwt, 2017) securing 8 to 10 months period cover with delivery in the Bay of Bohai and worldwide redelivery at a $18,000 for account of Ultrabulk

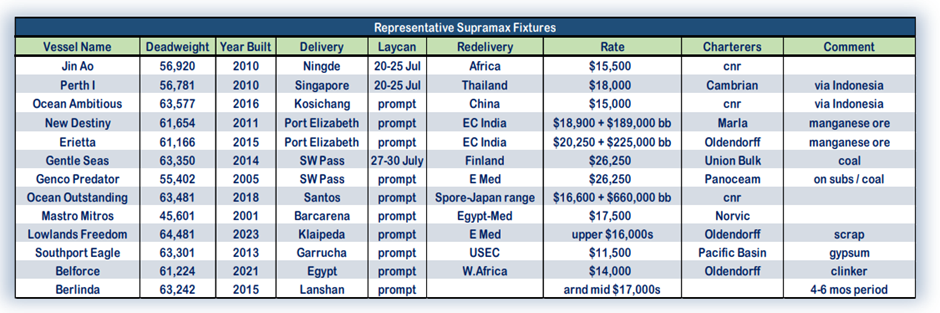

Supramax

The Supramax market experienced a mild improvement this week, with the BSI 10 TCA increasing by 0.8% to close at $15,117. The overall sentiment was mixed, with the Atlantic showing more activity and the Pacific and Indian Oceans maintaining a stable outlook.

Pacific

The Pacific market saw a marginal improvement, with the BSI 3 TCA increasing by 2.0% to close at $13,535. In the Far East, the ‘Jin Ao’ (56,920 dwt, 2010) was fixed from Ningde for a trip redelivery to Africa with steel at $15,500 daily. The ‘Zola’ (63,667 dwt, 2018) was on subjects for a trip via Indonesia redelivery South China at $16,000 daily. Southeast Asia saw fixtures such as the ‘Perth I’ (56,781 dwt, 2010) reportedly gone basis delivery Singapore for a trip via Indonesia to Thailand at $18,000 and the ‘Ocean Ambitious’ (63,577 dwt, 2016) fetching $15,000 with delivery Kosichang for a trip via Indonesia to China. On macro factors that had a bearing on the regional market, China’s total coal imports reportedly increased by 5% month-on-month and 12% year-on-year in June.

This increase has undoubtedly contributed positively in the healthy rates these runs are currently being trading at. In the Indian Ocean, activity was stable, although reported fixtures out of the Persian Gulf and the Indian subcontinent were rather scarce. Several fixtures though were heard from South Africa like the ‘New Destiny’ (61,654 dwt, 2011) that was fixed from Port Elizabeth for a trip redelivery East Coast India with manganese ore at $18,900 plus $189,000 ballast bonus, and the ‘Erietta’ (61,166 dwt, 2015) that secured similar employment at $20,250 plus $225,000 ballast bonus.

Atlantic

The Atlantic market showed mixed performance. North America experienced a strengthening of rates, supported by the S1C_58 (USG trip to China/S.Jpn) route, which remains strong at $26,064, and the S4A_58 (USG to Skaw-Passero) route, which increased by 3.2% weekon-week to $22,743 despite taking a midweek breather. Notable fixtures included the ‘Gentle Seas’ (63,350 dwt, 2014) from SWP for a trip to Finland with coal at $26,250 and the ‘Genco Predator’ (55,402 dwt, 2005) from SWP to the East Mediterranean with coal at $26,250. In the South Atlantic things were quietter as fixtures reports suggest.

The ‘Ocean Outstanding’ (63,481 dwt, 2018) was agreed for a trip from Santos for a trip to Singapore-Japan at a lukewarm $16,600 plus a $660,000 ballast bonus, and the ‘Mastro Mitros’ (45,601 dwt, 2001) was gone for a trip from Barcarena to Egypt/Mediterranean at an equally uninspiring $17,500 APS. The Continent region saw fixtures at improved rates like the ‘Lowlands Freedom’ (64,481 dwt, 2023) from Finland for a trip to the Eastern Mediterranean with scrap at upper $16,000s. From further south, the ‘Southport Eagle’ (63,301 dwt, 2013) was agreed at $11,500 daily with delivery Garrucha for a trip to USEC with gypsum.

Meanwhile, the Mediterranean is yet to catch up, even though Ukraine’s grain exports for the 2024/25 season rose to almost 2 million metric tons by mid-July. Asian wheat buyers have also stepped up purchases from the Black Sea region due to lower prices, which could positively affect demand in the area in the short run. Fixture-wise, the ‘Belforce’ (61,224 dwt, 2021) was chartered from for a trip from Egypt to West Africa with clinker at $14,000 daily.

Time charter period activity saw some notable fixtures, reflecting cautious optimism in the market. The ‘Berlinda’ (63,242 dwt, 2015) was fixed from Lanshan, North China for 4-6 months at around $17,500.

The overall sentiment was mixed, with the Atlantic showing more activity and the Pacific and Indian Oceans maintaining a stable outlook.

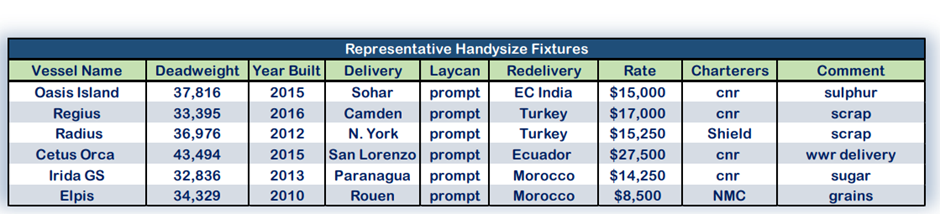

Handysize

Two tier market or all against two for the Handysize market? My predictions so far whether it is the market or football, are offering opportunities for betting against, but I don’t see or hear anybody willing to pick up on that. Argentina took us to the cashiers, England did not and the market seems to still holding on to its levels. Apart the first two routes, the rest seem to be in trance and just keep moving forward. Far East is steadily adding some value to all routes, while Atlantic seems to be hit from the slowdown coming from the ‘summer heat’ in Europe but the rest of the ocean seems to be holding on. Nevertheless the average of the routes in Atlantic still trails that of the Pacific by more than $1,100, which is still rather unusual whichever way we try to measure it. The 7TC Average this week moved positively and closed today at $13,543 or 1.5% higher W-o-W.

Pacific

The Pacific seemingly is ‘on the rebound’ with the routes mostly moving positively this past week, but the truth is that we noticed a drop in volumes but with levels holding on. All in all the 3 routes’ average this week moved again positively adding 1.4% W-o-W. South East Asia was rather volatile with Australian traders in search of the last July stems which apparently were not there.

Weaker numbers for Aussie rounds was a logical result. Otherwise the rest of the market in the area tried for another week yet again to pick up the slack, and barely managed to do so. Of course some opportunities exist for ‘exciting’ destinations and high-end cargoes for those who are willing to test them. Sentiment for next week is slightly softer. Up towards the North, we noticed a small reluctance from Owners to commit their ships on backhaul trips, causing the rates towards the Atlantic to pick up slightly, dragging along other out of the area destinations like WCSA and PG. Again this small ‘excitement’ spelt over to the rest of the local trips, adding some pressure to traders and charterers who still try to keep the rates contained at last done levels.

Sentiment for next week is mixed, since the ‘struggle’ seems will continue. In the Indian Ocean we noticed a two-tier market developing. EC India while not very healthy in terms of cargo supply, saw the previous week most ships ballasting to SE Asia, leaving limited options on the coast, while WC India remaining very slow and finally Persian Gulf being extremely active.

Fertilizers out of the Gulf paid rates over the mid-teens for large ships, even for destinations to Far East and SE Asia. Sentiment for next week is mixed, since as fast this picked up, so fast can again slow down.

Atlantic

The Atlantic market is still in two speeds with the East side of the ocean in a downward spiral and the West side still pushing upwards. For another consecutive week, the average movement of the 4 routes was close to ‘zero’ and actually lost 0.1% W-o-W. USG was the big winner adding on the route $1,028 and making it to the 1st place of all the handy routes in value!

While seemingly the tonnage list is rather long, a lot of activity happens under the radar in a desperate effort from Charterers to put a lid on rates. Apparently this trick has not worked yet. Sentiment for next week remains positive, especially since we do see August dated cargo hitting the market. Further to the south the ECSA market started the week with a feeling of uncertainty and caution all around, but as the week progressed the ‘end of the month rush’ settled in and a small surge in fixtures gave a breath of fresh air in the market. This was mostly evident in larger size ships, while the options for smaller sizes are still limited.

A few cargoes ending up to WCSA produced a few high rates which shook things around a bit. But sentiment for next week remains mixed since we need a lot more cargo to see steady improvement on rates. On the other side of the ocean the Continent market is still experiencing a lot of challenges in the supply of cargo and a logical decline in rates. Russian Baltic cargoes are trying to pick up the slack but in reality this is a different supply and demand market altogether and has little effect to the rest of the market’s struggle.

Sentiment for next week remains rather negative. South in the Med, for another consecutive week, the market remained relatively quiet with a limited amount of fixture concluded and heard. Some grain tenders from Algeria and Egypt popped up but dates were for September onwards and the ‘excitement’ died down fast. Russian and Ukrainian cargoes are still in slim supply and the ‘firm’ ones are even slimmer. Sentiment remains rather negative still. Period activity was held under wraps but we heard rumours of a 35,000dwt ship fixing a medium period at $14,000 from NCSA for worldwide trading.

The 2 Oceans are slowly trailing apart.

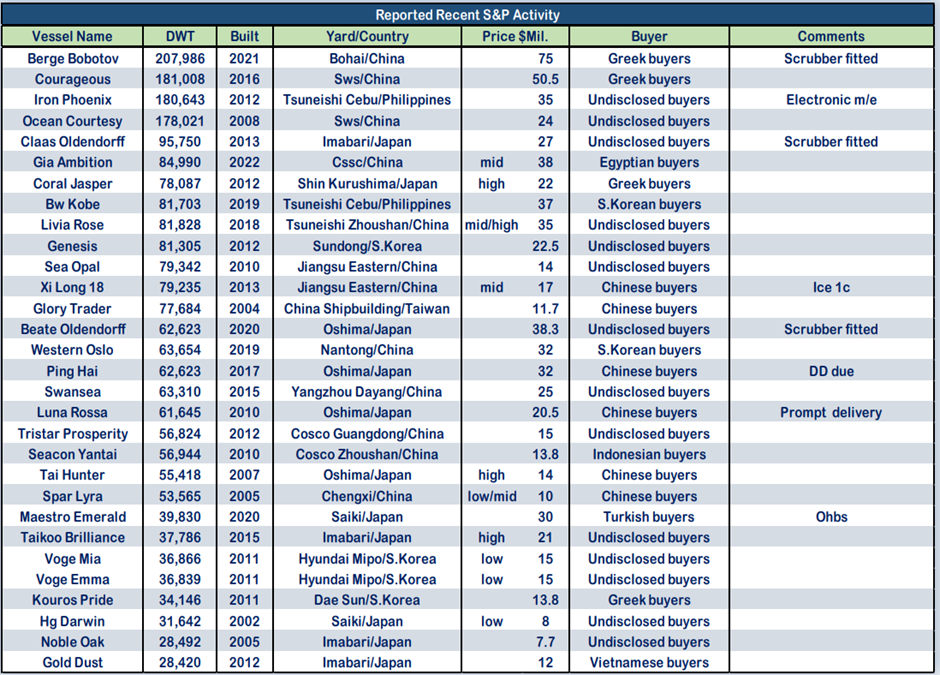

Sale & Purchase

As we creep deeper and deeper into the summer, more and more players are taking their foot off the gas pedal and settling into cruise control. But that doesn’t mean activity has come to a full stop. There are some buyers still on the lookout. Most of the reported activity this week transpired within the Handysize segment, and much of the prospective buying interest has focused on ultramax BCs. We’ve seen a few fresh mid-aged Supramax and Handysize BCs hit the market.

Additionally, the market has had a few private candidates appear, as some owners continue to want to test the waters and perhaps be one of the sellers to make a sale at a firm price. As prices remain firm and in some cases continue to firm wherever competition arises, it remains to be seen how the secondhand market evolves; it will likely reveal its updated face come autumn. Looking to this week’s reported activity, the scrubber-fitted “Claas Oldendorff” (95.7k, Imabari, Japan, 2013) was reported sold for $27 mio. The “BW Kobe” (81.7k, Tsuneishi Cebu, Philippines, 2019) ended up with S.Korean buyers for $37mio, while Chinese buyers paid $11.7 mio for the “Glory Trader” (77.6k, China Shipbuilding, Taiwan, 2004). Moving down the ladder to geared tonnage, the “Seacon Yantai” (56.9k, Cosco Zhoushan, China, 2010) found a new home for $13.8 mio, purportedly to Indonesian buyers. In Handy news, on an en bloc basis, sisters “Western Durban” (39.2k, Jns, China, 2015), “Western Lima”, Western Miami” and “Western Paris” were reported sold for an aggregate price of $78 mio.

The “Voge Mia” (36.8k, Hyundai Mipo, S. Korea, 2011) and sister “Voge Emma” fetched low $15s each. Last but not least, the “Darya Ganga” (36.8k, Hyundai,S.Korea, 2012) obtained low $16s from undisclosed buyers. On the newbuilding front, Greek shipowner DryDel Shipping has placed an order for a newbuilding Ultramax at Tsuneishi Shipyard in Japan. Expected delivery is for 2028 and the vessel will comply with EEDI Phase 3 regulations with no further details regarding price.

The market has had a few private candidate appear, as some owners continue to want to test the waters and perhaps be one of the sellers to make a sale at a firm price.

Thank you! Have a safe weekend.

The Author

Mr Bansi Jaising

Chairman Emeritus

Pure Venture